Understanding what is tax planning is one of the most important aspect of financial planning. It is a practice where one analyzes his financial situation based on tax efficiency point of view so as to invest and utilize the resources optimally. Tax planning means reduction of tax liability by the way of exemptions, deductions and benefits.

Tax planning in India allows a taxpayer to make the best use of the various tax exemptions, deductions and benefits to minimize his tax liability every financial year. As responsible citizens of the country, paying Income Tax on time, capital gain tax on transfer of capital assets on your income is mandatory for the country to grow. However, majority amongst us still refrain from paying income tax which in turn curbs country’s growth and put you under direct suspicion of IT official where if found guilty, you are subject to heavy fines and imprisonment. Thus instead of avoiding income tax, one should readily pay tax yet save money by investing in tax saving instruments under different sections of the IT Act, 1962.

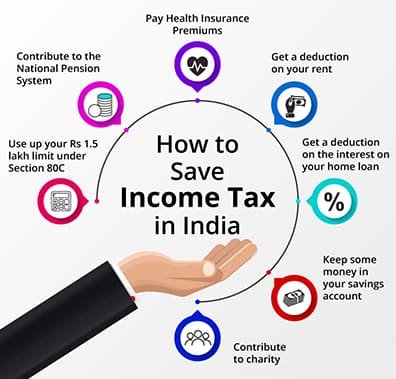

Taxpayers are provided with several options to reduce their tax liabilities. Various sections of the Indian income tax law offer tax deductions and exemptions, of which, Section 80C is the most popular tax-saving avenue. For e.g., Provident Fund, Deposits in Public Provident Fund , Five Year Bank Deposits, National Savings Certificate, Investment in ELSS schemes, Life Insurance, Principal repayment on housing loan, Stamp duty, Sukanya samriddhi Yojana (SSY), Senior Citizen Saving Schemes, Infrastructure Bond, Tuition Fees etc. Apart from that one can have additional deduction of ₹50,000 is allowed for amount deposited in NPS account. There are other deductions under different schemes like 80D for medical insurance & 80G for approved donation.